UCCU Members saved $10.5M in 2020!

Certified by Datatrac*

As a not-for-profit financial institution, UCCU is focused on helping our members save money. UCCU is honored to receive the Datatrac Great Rate Award®, certifying that we consistently outperformed the average rates of Utah banks. Thus providing our members with over $10 million in savings in only 12 months!

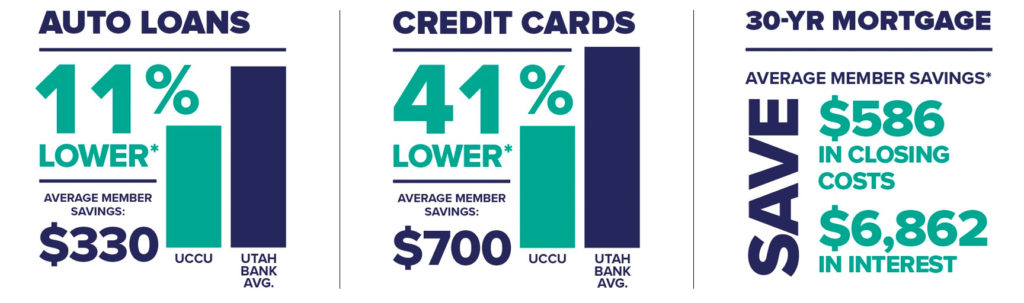

These savings come from the low rates we provide our members. Savings on auto loans, mortgages, home equity loans, credit cards, lower fees and a lot more, every day.

For example… with a 72-month auto loan from UCCU, you’ll pay approximately $330 less in interest than you would to the average Utah bank over the life of your loan. It’s easy to switch your loans to UCCU. You can do it from your phone or computer. The more you switch, the more you’ll also want to see how UCCU compares to other institutions around Utah? Check out our great rates page

UCCU is dedicated to saving its members money. They do this by offering lower interest rates on loans and higher interest rates (APY) on savings. This can help members save money on their mortgages, auto loans, credit cards, and also home equity loans. Follow the links if you are also interested in learning more about UCCU’s loan rates and savings rates.

If you are in need of a new loan, or already have a loan that you would like to save money on, contact us or apply for a loan or savings account.

*Information independently certified by Datatrac, the National Credit Union Administration (NCUA), and the Credit Union National Association (CUNA), which estimated that Utah Community Credit Union provided $10,569,489 in direct financial benefits to its 208,114 members during the twelve months ending September 2020, when compared to the average rates and yields of Utah banks.

- Previous

- New Branches: Draper & Herriman