Call or Text

(801) 223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

Submit a Question to our Support Team

or send us a message from inside online banking.

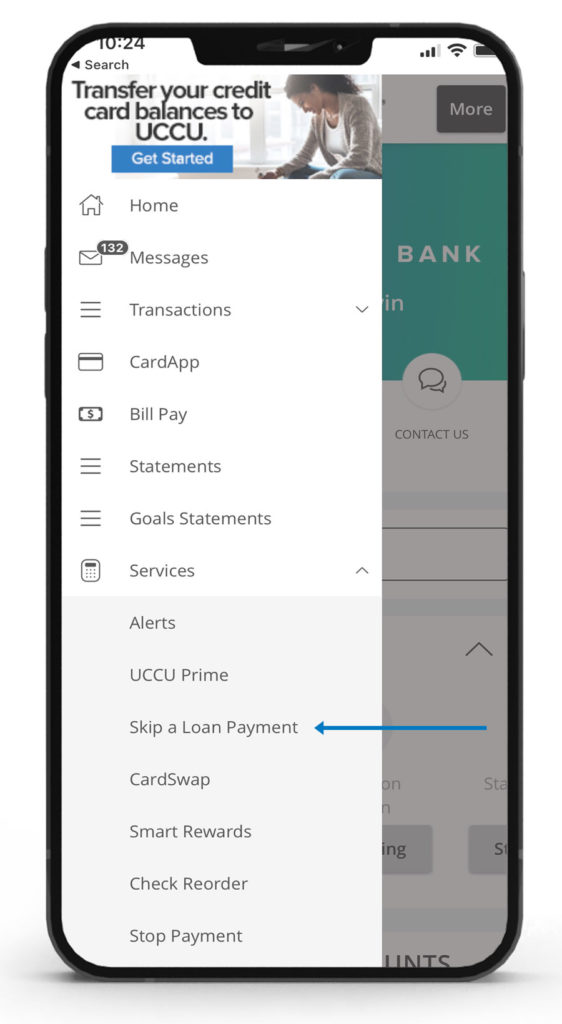

Skipping a loan payment is as easy as opening up your UCCU Mobile Banking app, selecting “Services” under the “Menu” tab, and finding the “Skip a Loan Payment” option. With a click of a button and a one-time fee of $25*, you can pause a UCCU loan payment any month of the year. Think of it as one less thing to stress about, anytime you need it.

How do I qualify for skipping a payment?

**For questions regarding detailed qualifications, contact a UCCU representative.

How do I skip my loan payment?

*You agree Utah Community Federal Credit Union (“UCCU”) will charge you a $25 fee for each skipped payment. You must have a satisfactory payment history and UCCU may deny your request for any or no reason. Skipped payments are not waived or forgiven; they are simply deferred and must be paid later. Your payments must resume following the one-month skip; your payment the following month will be due on the same date of that month it would have been due in the absence of a skip/deferment the prior month. Interest will continue to accrue during the deferral period and until your loan is repaid in full. Deferring a payment can cause negative amortization on your loan.

All terms of your loan agreement(s) remain unchanged if UCCU approves your request except: (a) the payment schedule will lengthen by one month, and (b) insurance products now in effect may not provide protection beyond the original maturity date. UCCU reserves the right to not offer you a payment deferral in the future.

Need to free up some extra cash? Start by deferring a loan payment any month of the year and resume payments the following month.

(801) 223-8188 | Branch Locations

Available M–F 8am–6pm, and Sat. 9am–2pm,

No. Eligible loans qualify for a max of two payment pauses per year (up to 5 for the duration of the loan). However, 3 standard monthly payments are needed in-between each monthly deferred payment.

Eligible Loans that can be a Payment include:

Loans that are not eligible for a month deferment include Credit Cards, Mortgage Loans, Home Equity Loans / HELOC’s and Checking Protection (Overdraft) loans

Yes. If you have a UCCU loan and automatic payment for that loan comes from separate financial institution, you will need to contact the paying financial institution to cancel or pause auto-payments for the UCCU loan. You will also need to pause your automatic transfer payment to your loan.

Call or visit a local UCCU branch for additional questions or support for pausing a loan payment especially when multiple financial institutions are involved in your UCCU loan payment

Cell Phone Protection, Roadside Assistance, Telehealth, and more!

Explore ContentDark Web Monitoring, Identity Protection, ID Theft Resolution, and more!

Explore Content(801) 223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

or send us a message from inside online banking.

Be advised UCCU does not provide and is not responsible for the product, service, overall website content, security, or privacy policies on any external third-party sites. The UCCU privacy and security policies do not apply to linked sites.

ContinueNotifications