Credit Scores: Your Questions, Answered

If the term “credit score” hasn’t come up in your life yet, it will. If you have ever wondered what it is, why it’s important, or what you can do to build a credit score, you’re in the right place. In this article, we will help you understand credit scores and answer the questions you have.

What Is a Credit Score?

A credit score is important because it helps lenders know how trustworthy you are with your money—basically, it’s a GPA for your finances.

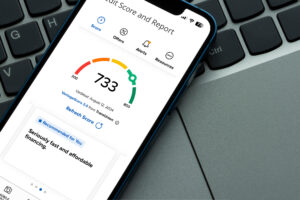

The three main credit bureaus you can find your credit score at are Experian, Equifax, or TransUnion. You can also view your credit score on the UCCU Mobile App.

Credit scores typically range from 300 to 850. This range is divided into several categories, each representing a level of creditworthiness. The categories are as follows:

- Poor credit: 300-579: This score may make it difficult or even impossible to get approved for credit or loans. If approved, you will face higher interest rates.

- Fair credit: 580-669: While you may get approved for credit, you’re still likely to face higher interest rates than those with good credit.

- Good credit: 670-739: This score should allow you to get approved for most credit products at reasonable interest rates.

- Very good credit: 740-799: This score will get you better interest rates and more favorable terms.

- Exceptional credit: 800-850: This score will give you access to the best interest rates and terms.

Understanding where you fall in this range can help you set realistic credit goals. It can also help you understand what lenders see when they check your credit.

How Do They Get That Number?

There are different factors that make up your three digit credit score. Here is a breakdown of what those factors are:

- Payment History: 35%: Lenders want to see that you have a history of paying your bills on time. Late payments have a negative impact on your credit score.

- Amounts Owed: 30%: This is the amount of credit you’re using compared to the amount of credit you have available. It’s generally recommended to keep your credit utilization below 30%. High credit utilization can signal to lenders that you’re overextended and may have trouble paying back your debts.

- Length of Credit History: 15%: The longer your credit history, the better it is for your credit score. Lenders like to see a long history of responsible credit use. If you’re new to credit, it may take some time to build up your credit history.

- Credit Mix: 10%: Lenders like to see a mix of different types of credit, such as credit cards, auto loans, and mortgages. This shows that you can handle different types of credit responsibly.

- New Credit: 10%: New credit inquiries can impact your credit score. When you apply for new credit, a hard inquiry is made on your credit report. This can cause a temporary and small dip in your credit score.

Why is This All Important?

Having a good credit score can impact buying a car, renting an apartment, buying a house, getting employed, and more—all things that you will experience one day if you already haven’t.

Your score will be the basis of interest rates and terms for loans that you will get. For example, if you have a credit score of 580 and are trying to get an auto loan, your interest rate might be 12%. But if you have a 740, your interest rate might decrease to 7%. This will end up saving you hundreds to thousands of dollars.

How Do I Start Building or Improving My Credit?

Paying attention to and monitoring how you are doing on the 5 different factors that make up your credit score are crucial in this process. If you consistently get your credit pulled or miss several payments on bills, your score can drastically decrease. So, check your credit report and pay attention to your credit score.

Besides this, here are two other things you can do to improve and build your credit score.

Getting a Credit Card

Credit cards can seem scary, but they can actually be a very good tool when used wisely. There are different ways you can use it, such as using the card only for a single purchase like gas each month, or for a lot of purposes and then paying it off each month through your bank account. Whatever you do, make sure to keep that credit utilization lower than 30%.

There are many credit cards to choose from with different rewards and interest rates, so you need to be careful about how you pick the best one for you. UCCU’s 4-3-2-1 Cash Back Credit Card might be a great option for you!

Read this article to learn more about getting a credit card for the first time.

Getting a Loan

There are many loans out there-some you may get and some you may choose not to. Common ones include auto loans, personal loans, and mortgage loans.

One option that is a great option for students is a Credit Builder Loan. This is a great option if you don’t yet want to get a credit card but want to start building credit. Or, if you have a credit score, this can be a great way to improve it.

UCCU Credit Builder is an innovative loan program designed to help you build or rebuild a credit history and score by making on-time loan payments.

This is how it works:

- UCCU will lend you a fixed amount of money (between $500-$5,000) with a small monthly payment.

- Those funds will be placed into a special savings account that will be used to make your monthly payments.

- As your monthly payments are made, your credit history builds.

You can choose the amount they deposit into your savings account as well as the duration of the loan, which can be 1-5 years. There will also be an interest rate attached to the loan.

You can also choose to make the payments automatic or manual, but automatic payments are best for making on-time payments, which is the biggest factor in helping to raise your credit score.

Where do I Start?

Now that you know what a credit score is and some of your questions have been answered, it’s time to get started.

Start by figuring out your financial goals. Do you have short term and long term savings goals? What do you want to improve financially in your life? What decisions are coming up in your life that will impact your financial state?

After you have figured out your goals, evaluate what role credit plays in that. For example, are you wanting to buy a car in the next 6 months but don’t have any credit built? It may be time to get a credit card.

Whatever you decide, know that there are resources available to help you. And once you get started, you will become one step closer to becoming a master of your finances.

- Previous

- A College Student’s Ultimate Guide