Call or Text

(801) 223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

Submit a Question to our Support Team

or send us a message from inside online banking.

Our history, membership eligibility, and beloved volunteers

To be the most loved, most trusted, and most utilized credit union in the nation.

Utah Community Credit Union is an organization rooted in the credit union philosophy of “people helping people” and built on traditional values of commitment to outstanding service, respect for others, and fiscal responsibility. We hold ourselves to the highest standards of honesty, professionalism, and integrity and are committed to achieving excellence in operations, products, and member service.

With consistent and reliable service delivery, we create trusting relationships with our members. We are a member-centric organization. Our decisions at all levels are based on what is in the best interest of the member while maintaining a financially strong and stable organization.

The philosophy driving our team-oriented staff really is to help members “reach their financial goals.”

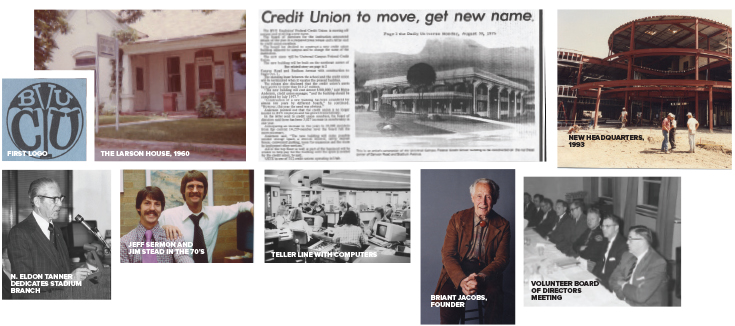

In 1956, seven BYU employees imagined something special for this community – a not-for-profit financial institution that wouldn’t answer to stockholders but, instead, would be owned by the very same people it served. And so, with only $35 from their own pockets, these founders established the BYU Federal Credit Union. It was a noble endeavor with humble beginnings. They couldn’t afford to rent office space, so they set up a table on a stair landing in the Herald R. Clark building and took turns, voluntarily helping people in need of financial services.

They couldn’t afford to purchase a vault, so cash was kept in a locked room and placed in a cast iron bathtub, covered with a sheet of asbestos to protect it from fire. Word of this tiny credit union, a financial institution that valued people over profits, spread, to families, friends, and neighbors. To people who wanted to improve their lives. To people who caught the vision of working together for the betterment of everyone involved. And as the people came, this tiny financial cooperative grew. First to the Larson House, complete with a modest sign that read “Credit Union,” posted out front.

Then, in 1977, the credit union opened its first official branch on Canyon Road in Provo, just north of the best football stadium on the planet – complete with safety deposit boxes, a fire-proof vault, and the convenience of drive-up lanes. And it officially changed its name to Universal Campus Credit Union… or UCCU for short.

And the people continued to come and the credit union grew….

At the dedication of that building, N. Eldon Tanner (member of the first presidency of the LDS church) emphasized the mission of this credit union when he said: “… that those who are managing this organization may all be blessed with the ability, desire, and determination to do what they do in the interests of those whom they serve, and that it may benefit those who contribute, who have their savings here, and who are depending on this organization to help them in times of need; that they may be honest and honorable and upright in every way in their dealings.”

These inspiring words continue to guide every employee and volunteer of the credit union today. The words stand as a testament to what people can accomplish together when they share a vision of helping others. From humble beginnings to a financial institution that serves members all over the world, UCCU has always been a not-for-profit, always owned by its members, and always about people helping people.

And that will never change.

Membership in Utah Community Credit Union is available to any individuals and businesses in the United States.

A Credit Union Anyone can Join!

Join online, over the phone, or at any branch location.

Justin Olson

Justin Olson’s professional career includes serving UCCU in various capacities for 23 years. Most recently, he served as the cooperative’s Chief Information Officer (CIO). He has also continued his education, earning his Master of Business Administration from Brigham Young University

Justin’s experience in financial tech paired with his innovative mindset and strategic vision continue to help UCCU move into the future with confidence and meeting credit unions needs.

UCCU’s voluntary Board of Directors is accountable for the establishment of corporate goals, the approval of major financial decisions, financial statements, corporate strategies, the allocation of major resources, the representation of UCCU in the community, and the supervising of the operations of the credit union.

The role of director requires dedication, good judgment, excellent decision-making skills, a solid understanding of the community UCCU serves, and a commitment of one’s time. In addition to regular, monthly board meetings, UCCU directors form other board committees that also meet on a regular basis, including the Executive committee, the Assets and Liabilities committee, and the Facilities/Operations/Technology committee.

UCCU is continually working to ensure our credit union is one of the most secure and financially stable institutions in the country.

Click below for a report on the credit union’s performance and reports from the president, the board of directors chairperson, and the chairperson from the supervisory committee.

The UCCU Supervisory Committee operates independently on your behalf to assure the financial integrity of your credit union.

This committee of local professionals is appointed by the Board of Directors and serves as a watchdog for the members. It is responsible for making sure members’ funds and interests are protected and the credit union’s financial records and operations are in order.

Our goal is for all UCCU members to receive quality service in an expedient manner. We are ready to assist you in resolving any credit union problem you may have.

Supervisory Committee Concerns and Questions

Attn: Steven V. Sorenson

UCCU Supervisory Committee

360 W 4800 N,

Provo, UT 84604

[email protected]

(801) 223-8188

Mon – Fri: 8:00 am – 6:00 pm

Sat: 9:00 am – 2:00 pm

or send us a message from inside online banking.