What is a Credit Card Balance Transfer?

Credit card balance transfers is moving your credit card debt from its current account to a new account, usually with a lower interest rate. Not only can a balance transfer save you money, but it can also help you pay off your debt faster.

However, credit card balance transfers are not always the right decision for every consumer. Some new accounts may have higher interest rates, adjustable interest rates that rise over time, or different timelines for payment that may not be feasible for your situation. Always make sure to read and understand the structure of the new account.

So, what is a credit card balance transfer? Keep reading to find out!

- Credit card balance transfer definition

- Pros of a credit card balance transfer

- Save money on interest

- Debt consolidation

- Improve debt utilization percentage

- Cons of a credit card balance transfer

- Balance transfer fees

- May end up in more debt

- Could impact credit score

- How much could you save?

- Credit card balance transfer process

Credit Card Balance Transfer Defined

A credit card balance transfer is defined as a transfer of funds from one credit account to another credit account. This typically requires a balance transfer percentage fee and a new annual percentage rate (APR) to consider.

Are you new to credit card terms and definitions? Visit this helpful article by the Consumer Financial Protection Bureau.

Pros of a Credit Card Balance Transfer

Balance transfers are strong financial option available to consumers. This can help lower the interest rate on your card or lengthen the payback time that can help save users large sums of money of time.

1. Save Money on Interest

If the credit card company you are considering offers a waived balance transfer fee and a lower APR, you could end up saving money by completing the transfer. Oftentimes, companies will offer a 0% APR on a balance transfer, which could equate to big interest savings for you.

2. Consolidate Debt

Most balance transfers allow you to transfer more than one balance to the new account. This means that if you had multiple credit cards with balances, you could consolidate those debts and payments into one account. This can make payments and overall debt management a lot easier for your budget or financial plans.

Interested in other options for debt consolidation? Find out about our consolidation loans here.

3. May Improve Debt Utilization Percentage

The credit bureaus look at your debt utilization percentage, which is the amount of credit you are using compared to the total amount of credit available. If you opened a new account and completed a balance transfer, you now have twice as much available credit.

As long as you do not spend using your original credit card, you will be using a smaller percentage of your debt utilization. This is a big win for your credit score.

Cons of a Credit Card Balance Transfer

While a credit card balance transfer can save you money, that does not necessarily mean it is your best option. There are some cons related to a transfer as well.

1. Balance Transfer Fees

Although often waived, you may have to pay a balance transfer fee to complete the transfer of debt. This fee is typically a percentage of the balance being transferred. This can help lower your overall interest rate to save money.

2. May End Up in More Debt

When you transfer credit from one account to another, you consolidate your debt into one location allowing other credit accounts to be empty and available to use. Be cautious that this does not increase your overall personal debt. It is common for many consumers to see available credit as an increase in available spending. It is imperative that you do not rack up a new balance on your newly opened credit accounts.

3. Could Impact Credit Score

If you transfer your balance to a new credit account, you may see a drop in your credit score. This occurs because the credit bureaus prefer users and accounts that have been open and have a history. Opening new credit accounts or having too many hard credit checks can affect your credit score. If this occurs, take the recommended steps to build your credit score by making on time payments, keep your credit spending at a healthy level, and keep old credit lines open. Over time, your score will begin to rise.

Want an updated credit report? Visit this helpful article to learn about free credit reports.

Example: How Much Money Could You Save?

The amount of money you could save on a credit card balance transfer varies from person to person. However, let’s look at a potential scenario where someone uses a balance transfer to their advantage:

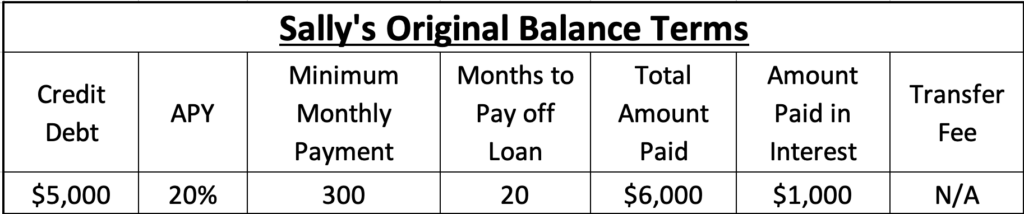

Sally has one credit card that has a $5,000 balance with a 20% APR. She pays $300 a month toward this credit card. If she does not spend any more available credit on this card, she would have it paid off in about 20 months and will have paid almost $1,000 in interest. (See chart below)

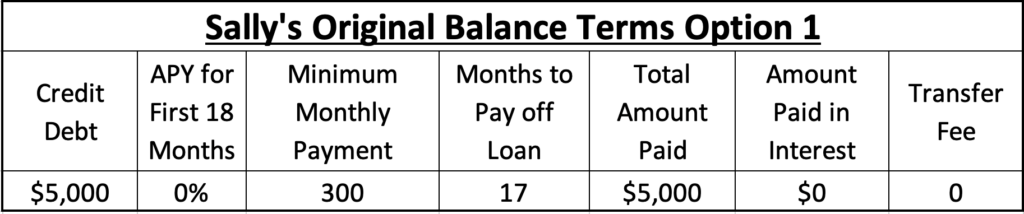

However, if Sally decides to do a credit card balance transfer of $5,000 to a new account that has a 0% balance transfer fee and 0% APR for 18 months, she will have her balance paid off in 17 months if she continues her $300 payments. She will also pay $0 in interest, saving her almost $1,000. (See Option 1 chart below)

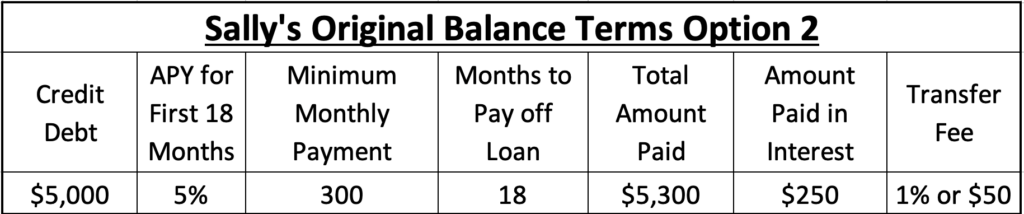

Let’s say Sally is not able to do a credit card balance transfer with a 0% fee and 0% APR for 18 months, but instead, can do one with a 1% fee and 5% APR for 18 months. She will have her balance paid off in 18 months and will pay only around $300 in interest fees for the balance. (See Option 2 chart below)

In Sally’s case, she saved a significant amount of money either way by completing the balance transfer. As long as she does not use the newly available $5,000 credit card balance, she will have saved money and will be increasing her credit score as well.

How to Start a Credit Card Balance Transfer Process

At UCCU, we make the process of opening a credit card balance transfer easy. To initiate a balance transfer request, contact at any of our local branches or by reaching out to us online. Many financial institutions, including UCCU, will have promotional periods for balance transfers during different times of the year, so be sure to ask what offerings are available. Once you find a balance transfer option that best fits your needs, we will walk you through the set-up process.

At UCCU, you have the benefit of working with a credit union that puts your needs and success first. We have an online form that requests a balance transfer instantly. We also offer a no fees balance transfer option. Reach out to our friendly customer service team or initiate a credit card balance transfer below.

Learn More About No Fee Balance Transfers